What Do We Trust?

- Scott Poore

- Nov 7, 2025

- 5 min read

The contradictory data that has been released during the government shutdown has made it difficult for investors to find a conviction moving forward. One wonders which

data set to trust. The inspiration for this week's musings is the 1992 movie, "Sneakers". Here’s some trivia about the movie:

Given the star power of this movie with multiple headliners the budget for the film was very reasonable at only $23 million. The release of the movie wasn't the best timing, just after the lucrative Labor Day weekend. And yet, the movie made more than $105 million.

The cast for the film included three Oscar winners - Robert Redford, Sidney Poitier, and Ben Kingsley. It also included five Oscar nominees - Dan Aykroyd, David Strathairn, River Phoenix, James Earl Jones, and Mary McDonnell.

The jacket work by Robert Redford in this film is the same one he wore in "The Natural" (1984).

Robert Redford appeared in the 1973 movie "The Sting" with James Earl Jones' father, Robert Earl Jones.

The facade of the building in the initial scene of the movie where Martin and Cosmo attempt their prank is the famous Hill Valley clock tower from "Back to the Future."

Here's what we've seen so far this week...

Too Many Secrets. The premise behind the movie "Sneakers" is that an algorithm has been discovered that can decode major global systems that operate on technology.

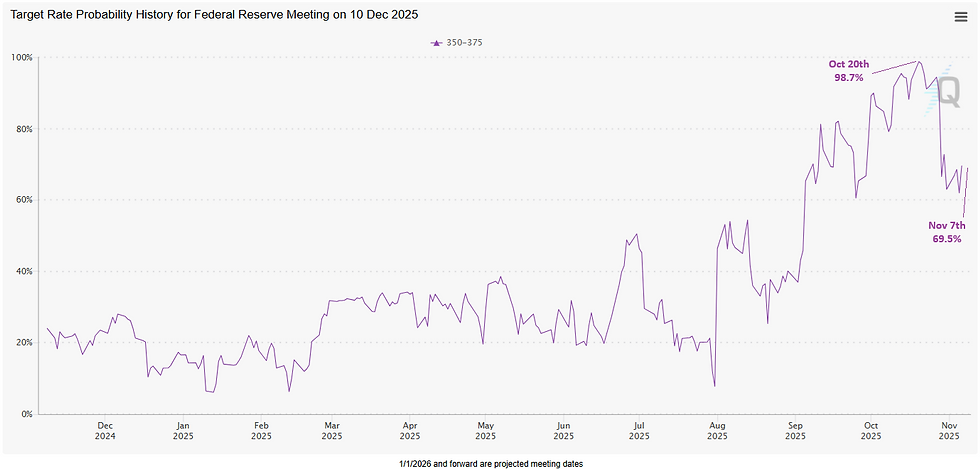

Throughout the movie, it becomes difficult to determine who Marty (Robert Redford) can trust other than his inner circle. That's how investors feel at the moment. The Fed promised three rate cuts in 2025 at their September meeting. Now, a December cut (which would be the 3rd cut) is in doubt. Futures on a rate cut at the Fed's last meeting this year have fallen from 98% just 3 weeks ago to 69% as of today.

The current shutdown of the government has dragged on now longer than any other shutdown in history. It has now been 38 days and counting that the shutdown has

proceeded and there could be some short-term effects beginning to emerge. As politicians blather on about who's responsible for the shutdown, federal employees continue to miss paychecks (while those in Congress continue to get paid), economic data releases are delayed, and the banking system is experiencing stresses. During government shutdowns, federal spending halts, reducing outflows from the Treasury General Account. This has caused at least $700 billion in liquidity to be drained from the banking system and the Fed's Repo facility. At the end of October and beginning of November we saw banks rush to the Fed's Standing Repo Facility to gain temporary liquidity. This could have been interpreted as a bank liquidity crisis, but the Fed is providing a buffer so far.

The average government shutdown only lasts about 10 days, which is usually not long

enough for many paychecks to be missed. However, as this government shutdown has dragged on, the more than 3 million federal employees have been playing the waiting game, which is starting to show in some consumer spending metrics. Investors could take this as a slowdown in the economy, when it is more likely due to the shutdown affecting the economy. Redbook Sales data continue to show solid, consistent spending, but how long until the data picks up an exhausted federal employee?

The Brass Ring Is In The Eye Of The Beholder. The final scene in "Sneakers" shows the group having captured the "black box" and offering to turn it in to the NSA (National

Security Agency). The group asks for quid pro quo for their good deed and the youngest member of the group, Carl, asks for the female agent's phone number. When Marty tells him this is the "brass ring" and to think bigger, Carl simply responds, "I just want her telephone number." Sometimes we need to see the "bird in the hand" instead of seeking everything. The Atlanta Fed is currently projecting 3rd quarter GDP to come in at +4.0%. If we can ever get the government re-opened, we'll find out for sure with the release of the official GDP number. However, the Fed's data has led them to the conclusion that Q3 GDP will be the strongest single quarter of growth since the 3rd quarter of 2023.

Most of the damage in equities this week has been done in the concentrated, momentum names - most specficially Mag 7. The Mag 7 names - Apple, Microsoft, Google, Meta, Netflix, Nvidia, and Tesla - are down 4.5% as a group for the week, with the S&P 500 Index down only 2.5% over the same time period. The majority of the S&P (54%) are still trading above their respective 200-day moving average. It's been an astounding year for equities in terms of total return, so a pull back between 2-5% was expected and likely healthy. We'll see if it amounts to more than just a pull back.

The growth rate of earnings for S&P 500 companies was quite strong in the 3rd quarter. Consumer spending drives corporate earnings and earnings drive stock prices. What is fascinating is that earnings calls show an increase from Q2 to Q3 noting the government shutdown as a potential problem to forward projections. Meanwhile, the number of calls noting tariffs and uncertainty decreased sharply from Q2 to Q3 on earnings calls. An end to the government shutdown should ease banking liquidity and get consumers (especially federal employees) focused on the the holiday season. If equities do not improve in time for the "Santa Rally", it could mean that there is some tough sledding ahead for 2026.

The wish list scene...

____________________________________________________________________________________

Disclosures

The information contained herein is for informational purposes only and is developed from sources believed to be providing accurate information. The opinions expressed are those of the author, are for general information, and should not be considered a solicitation for the purchase or sale of any security. The decision to review or consider the purchase or sell of any security should not be undertaken without consideration of your personal financial information, investment objectives and risk tolerance with your financial professional.

Forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

Any market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

Past Performance does not guarantee future results.

Comments