Tariffs, Volatility, and Shutdowns

- Scott Poore

- Oct 13, 2025

- 3 min read

The market experienced a volatility shock on Friday after the White House threatened tariffs on China. China recently announced "export controls" on rare earth minerals

that was classified by the White House as a borderline embargo. As a result the White House raised tariffs to 100% on Chinese imports. This sent shock waves through the market which triggered a VAR event. Large hedge funds utilize VAR (value at risk) models. When volatility suddenly spikes, their models trigger requiring them to sell assets to stay within risk limits. Equity markets dropped more than 2% on Friday as a result of the massive selling. As we have mentioned before, pullbacks occur often and are typically short-term in nature. A 3% dip in equity prices occurs at least 7 times per year on average. As an end to the government shutdown is not apparent today, more dips in equity prices are possible.

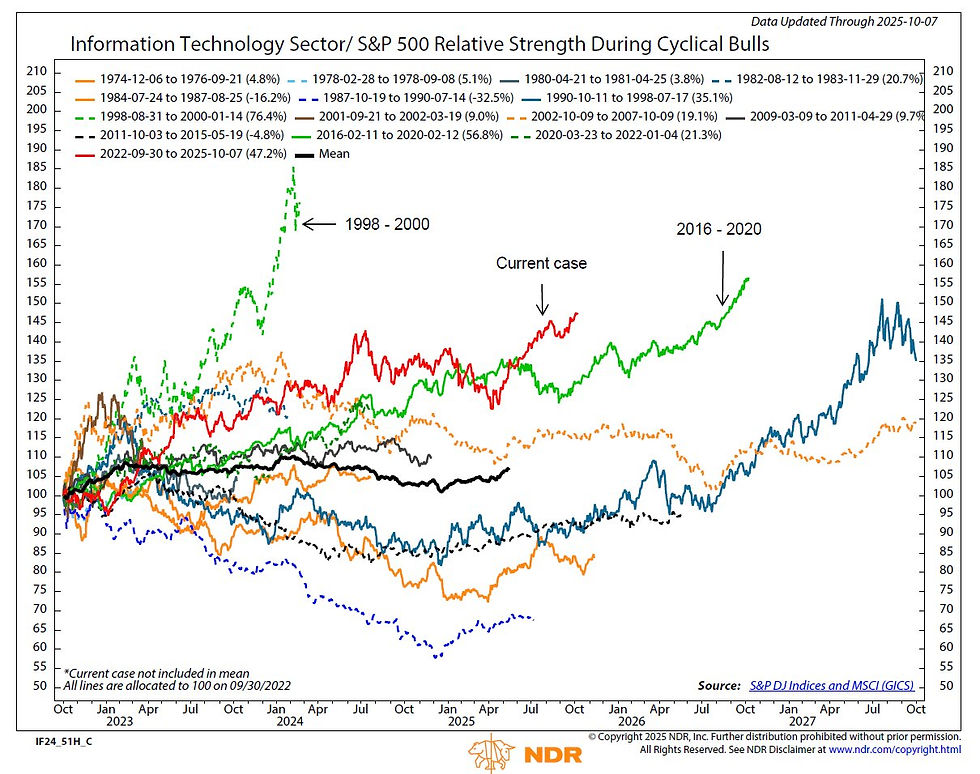

News media are working overtime to label the current market environment as the next "tech bubble." However, the comparisons are not all that solid. In prior bull markets,

media have called markets over-priced when bull markets are still young. The current bull market just turned three and the price action doesn't seem to represent a bubble just yet. In fact, the current technology sector performance looks more like the 2016-2020 period than it does the Dot.com bubble of 1998-2000. It's important for investors to keep their current risk tolerance in check and to trust their financial plans rather than take investing advice from the media.

Unlike prior investing bubbles, U.S. households are in much better financial stability today.

U.S. households currently have a dollar in cash for every dollar of debt. In other words, they are the most deleveraged since the early '90s. As consumers continue to spend, the economy continues to grow. It's not just about the AI story. U.S. consumers still make up nearly two-thirds of GDP. Second quarter GDP was revised higher to +3.8%. The Atlanta Fed is estimating 3rd quarter GDP to also come in at +3.8%. The New York Fed is estimating 4th quarter GDP to come in at +2.3%. If 3rd & 4th quarter GDP releases indeed follow that trajectory, a recession in 2025 is not possible, as a recession is defined as two consecutive quarters of negative GDP. Equity futures are solidly in the green this morning, so perhaps the toned down language by both the White House and China over the weekend will calm markets down this week.

Disclosures

The information contained herein is for informational purposes only and is developed from sources believed to be providing accurate information. The opinions expressed are those of the author, are for general information, and should not be considered a solicitation for the purchase or sale of any security. The decision to review or consider the purchase or sell of any security should not be undertaken without consideration of your personal financial information, investment objectives and risk tolerance with your financial professional.

Forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

Any market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

Past Performance does not guarantee future results.

Comments