Like It's 1999?

- Scott Poore

- Oct 9, 2025

- 5 min read

Updated: Oct 10, 2025

So much is being made of the comparisons between the current market environment and that of the late '90s. But are the comparisons fair? We'll dive into the correlations

in this week's Market Musings. The inspiration for this week's musings is the 1982 hit song, "1999" by Prince. Here’s some trivia about the song:

This song hit #44 on the Billboard charts initially in 1982, but a re-release in 1983 pushed the song all the way to No. 12. The song sold more than 1 million copies and was certified Gold in the U.S. and U.K.

This song was written by Prince near the height of the Cold War, as the U.S. and Russia were stockpiling nuclear weapons. Prince hoped the song would portray some optimism during a frightful time.

Leading up to a pay-per-view event that aired on New Year's Eve 1999, Prince vowed to retire the song. He lived up to his word, until his Super Bowl halftime appearance in 2007.

Prince doesn't sing on this track until the third line in the song. The first lead vocal is by backup singer Lisa Coleman. After Coleman, guitarist Dez Dickerson sings the next line. Then, Prince comes in on the third line. Originally, Prince envisioned the song as a 3-part harmony with Coleman, Dickerson, and himself. Instead, he split up the tracks, letting each voice stand on its own.

"I was dreamin' when I wrote this

Forgive me if it goes astray

But when I woke up this mornin'

Could've sworn it was judgment day

The sky was all purple

There were people runnin' everywhere

Tryin' to run from the destruction

You know I didn't even care

'Cause they say two thousand zero zero

Party over, oops out of time

So tonight I'm gonna party like it's 1999"

Here's what we've seen so far this week...

Out Of Time? News media do not feel they are properly doing their job if they fail at stoking fears every other week. The latest buzz in the media shows an

increase in the use of "tech" and "bubble" over the past few weeks. And, that was also the case at different points in 2023 and 2024 - both years in which equities gained double-digits. When times are good, there isn't much news to sell consumers of media because everyone is feeling positive, so the media has to create something to drive ratings. That's not to say that a point will never arrive when the market hits a proverbial wall. However, the ability to call a market top or market bottom is something very few, if any, possess as a skill set. In addition, bull markets last longer, historically, than bear markets, so wishing for the next bear may disappoint the recessionistas.

As an example of how not to use the media as a means of financial advice, this headline written in October of 1998 that a "crash" was coming should serve as a reminder. Granted, there were two identifiable crises in 1998 - Long-term Capital bankruptcy and the devaluing of the Russian Ruble. Equities pulled back approximately 13% when the Russian central bank decided to devalue the Ruble and also declined 10% when Long-term Capital Management, a highly-leveraged hedge fund, collapsed. However, from the point of this headline about a coming crash the markets gained more than 40% over the following 15 months. No two markets are fully alike, so the idea that the media will correctly call the next market top based on a similar performance path as a prior market environment is not highly likely.

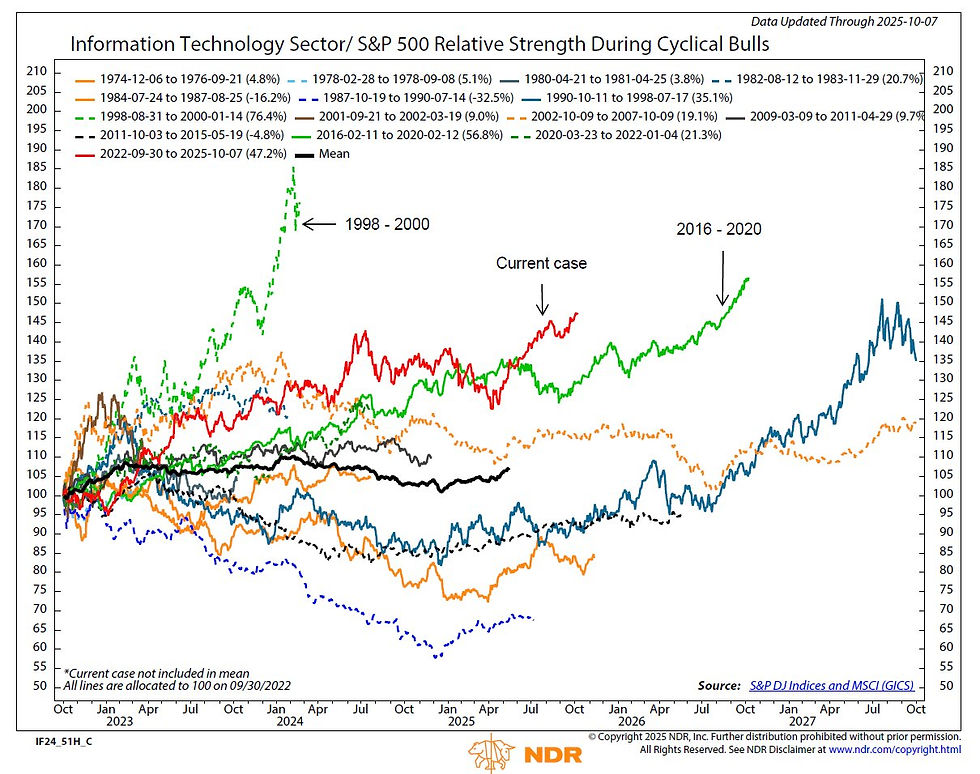

If anything, the current rise in technology, obviously driven by AI, is not really like 1999 all that much. The comparisons being made between 1999 and today are heavily

influences by the rise in valuations. Admittedly, valuations are elevated. However, current market prices are being driven by real revenues and profits, which is very different from 1999. In fact, from a performance standpoint, the Technology Sector is actually performing more like the 2016 to 2020 period rather than the 1998 to 2000 period. Valuations alone are not a reason to sell or buy equities. With other measures like strong economic fundamentals and low risk measurements currently present, it's more likely that there is still time left on the current bull market.

Forgive Me If I Go Astray. Unlike the Dot.com crash in 2000 and the Great Financial Crisis in 2008, households are much more healthy today, in terms of financial stability.

U.S. households currently have a dollar in cash for every dollar of debt. In other words, they are the most deleveraged since the early '90s. As consumers continue to spend, the economy continues to grow. It's not just about the AI story. U.S. consumers still make up nearly two-thirds of GDP. Second quarter GDP was revised higher to +3.8%. The Atlanta Fed is estimating 3rd quarter GDP to also come in at +3.8%. The New York Fed is estimating 4th quarter GDP to come in at +2.3%. If 3rd & 4th quarter GDP releases indeed follow that trajectory, a recession is not possible, as a recession is defined as two consecutive quarters of negative GDP.

As we've already mentioned, the tech sector is producing profits that are measurable. Current guidance from tech companies indicates another strong quarter for earnings growth in the 3rd quarter. During the Dot.com bubble, companies were not generating profits anywhere close to the current tech leaders. Nvidia, Amazon, Microsoft, Google, and Meta, to name a few, are all generating revenues in the billions annually. In 1999, most of the internet-based companies were generating less than $100 million in annual revenues, with some even operating without a profit at all. That market was much more speculative than the current market.

If we compare the Fed's National Financial Conditions Index for today versus 2007 and 1999, we see a different picture. Currently the index is below zero, and has been since 2022, meaning that financial conditions are loose or strong. In 1998, the index went into positive territory 3 times before the bubble eventually burst in 2000. Similarly, the index reached positive territory in 2007 and stayed there throughout the 2008 recession. The greater risk today is the psyche of investors. As with the exuberance of 1999, investors stretched their asset allocations beyond their stated risk tolerance and leveraged their portfolios in too much technology exposure. Investors and financial advisors alike would be well served to keep expectations realistic and maintain their equity exposure within normal risk tolerance levels.

Like it's 1999...

________________________________________________________________________________________________

Disclosures

The information contained herein is for informational purposes only and is developed from sources believed to be providing accurate information. The opinions expressed are those of the author, are for general information, and should not be considered a solicitation for the purchase or sale of any security. The decision to review or consider the purchase or sell of any security should not be undertaken without consideration of your personal financial information, investment objectives and risk tolerance with your financial professional.

Forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

Any market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

Past Performance does not guarantee future results.

Comments