Freedom vs. Discipline

- Scott Poore

- Oct 31, 2025

- 6 min read

October has lived up to its hype as a volatile month and has tested the mettle of the average investor this year. The Fed has delivered on another rate cut, but the prospect

of a third cut was left to interpretation. Months like this will cause investors to re-examine their investment plans. The inspiration for this week's musings is the 1992 movie, "A River Runs Through It". Here’s some trivia about the movie:

The movie was filmed on a meager budget by 1990s standards at only $12 million, due largely to the complete lack of special effects. Nearly 80% of the movie was filmed in the outdoors in the majesty of Wyoming and Montana. The global box office receipts totaled more than $43 million. It was nominated for 3 Oscars and won 1 for Best Cinematography.

Robert Redford, who does not star in this movie, fell in love with the book, which carries the same name, and was determined to turn it into a film. He apparently courted the author Norman Maclean for years before he finally gave in. Redford serves as a narrator in the movie, speaking as an older Maclean.

Brad Pitt auditioned for the role of Paul Maclean twice. He felt his first audition was poorly executed, so he sent in an additional video tape to the director. William Hurt also wanted to play the role of Paul, so he went fishing with Norman Maclean to lobby for the role. Maclean responded when asked by Hurt for his blessing, "Well, Bill, you're a pretty good fisherman but not good enough to be my brother."

Tom Skerrit plays the role of Reverend Maclean, the boys' father. He has publicly stated it is his favorite of all the films he has starred in.

Sometimes the fiction of Hollywood differs substantially from real life. In reality (spoiler alert), Paul didn't work for a local paper in Montana, but actually played football at Dartmouth, lived and worked in Chicago. He doesn't die in Montana, as depicted in the movie, but rather was murdered in Chicago. A lesson for the romantics out there that life is sometimes less glorious than the magic of film.

Here's what we've seen so far this week...

Like A Four-Count Rhythm. Like they are prone to do, the Fed decided to throw a wrench in the works this week with the FOMC meeting. As widely expected, the Fed

lowered interest rates by 25 basis points. However, despite the fact that the Fed's own Dot-Plot showed rates ending at 350-375 by year-end, the board cast doubt on a December rate cut. In one breath, Fed Chairman Powell stated, "Available data suggests outlook has not changed." Yay, so a December rate cut makes sense, right? Well, in the next breath he stated, "Another cut in December is far from assured." This sent futures on a December rate cut plummeting from more than 91% just one week ago to only 63% as of this morning. In fact, there was even a 5% probability of a 50 basis point cut in December, that has been thusly eliminated.

The period of time from Halloween to Thanksgiving is typically the setup for what investors like to refer to as the "Santa Clause Rally." Well, Powell decided to throw cold

water on that prospect for the time being. Thanks, Mr. Grinch. According to Powell, several Fed members had "strongly different views" on a December rate cut. It would appear the Fed is trying to curb the market trading ahead of a potential rate cut in December. According to Nick Timiraos, the so-called "Fed Whisperer" at the Wall Street Journal, "Powell's press conference suggests the FOMC is broadly not on board with how heavily priced a December rate cut had become."

While we do not have a reading for the Producer Price Index for September, last week's publication of the Consumer Price Index showed the reading at 3.0%, slightly higher

than the September number (+2.9%), but lower than expected (+3.1%). The Cleveland Fed's own website shows an expectation of October's CPI to come in flat at 3.0%. If the "outlook has not changed" and the Fed is expecting inflation to come in flat for October, why the hesitancy for a December rate cut? I would compare the Fed's sudden turn to a four-count rhythm in fly fishing. The Fed's double-speak is as consistent as Reverend Maclean's fly fishing instruction to his sons that a four-count rhythm will cause a fish to rise.

Watch Out For The Waterfall. The Maclean brothers are dared into rowing a boat down the falls of the Big Blackfoot River as young men. While the idea sounded great

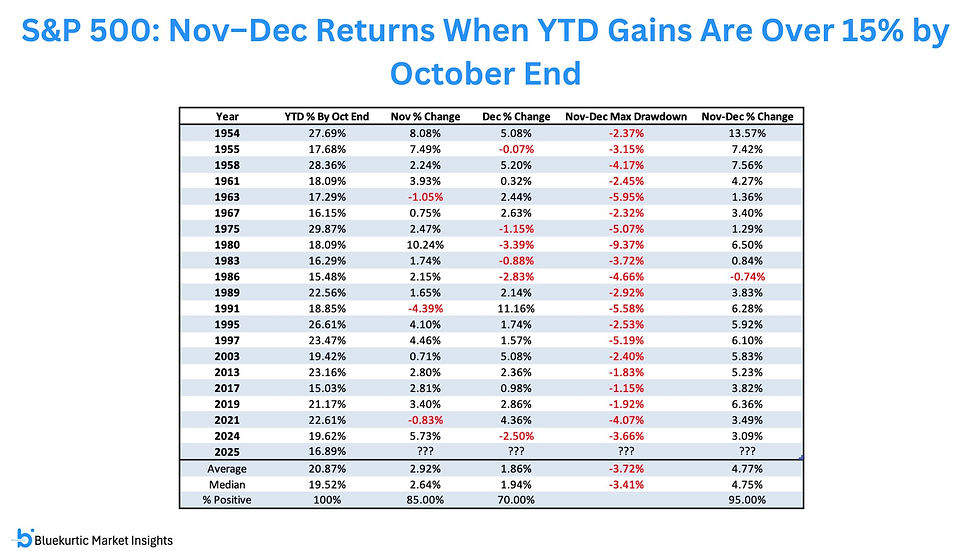

at the time, largely due to liquid courage, it doesn't carry the same lure once they smash their boat on the rocks and barely survive. Such is investing in equities. On the positive side, when the Fed cuts rates within all-time highs on the S&P, stocks are typically positive 1-year later. In similar fashion, when the year-to-date return on the S&P 500 Index is up over 15% by October end (currently +16%), the November-December return is positive 95% of the time, going back to 1954, with the average return +4.77%.

If you're a bear betting on the market to fall apart, there's only a 5% chance of that happening, according to historical data. Even if the 5% scenario were to occur, the average max drawdown for the November-December period is -3.72%, which would be a healthy pull back from current levels.

Unlike the magic generated in the movies, investors need to prepare for realistic expectations instead of always being on the winning side of a trade. The best way to accomplish this is to be diversified in such a way that long-term risk tolerance is matched by long-term asset allocation. Currently, there are some danger signals in the market fundamentals with regard to Private Credit. Currently, $500 billion of private credit has been deployed in new loans in 2025. That amounts to a total of $1.5 trillion in global private credit in the market. Several companies conduct due diligence and rate private credit - Kroll, Egan-Jones, Morningstar DBRS, & EuroRating - to name a few, but their ratings are not published so it's difficult to determine how much private credit is considered "risky." Private Credit currently accounts for 35% of insurance companies' assets. This is something we will need to watch moving forward.

Lastly, a technical indicator known as the "Hindenberg Omen" recently triggered. The

success of this indicator is spotty. Sometimes the omen signals a downturn, sometimes it triggers with harmless results. However, it could mean that a correction is on the horizon. For example, the omen triggered in December of last year and two months later the market pulled back more than 18%. The omen triggered in September of 2024, that resulted in barely any short-term equity losses in the S&P 500. The recent trigger runs in the face of strong economic fundamentals and positive seasonality, but again, this is something investors should consider. A diversification strategy that matches long-term risk tolerance and return expectations is the best defense against a market pull back. Now is a great time to meet with clients to insure they are not taking on more risk than their long-term expectations and goals would suggest.

The classic final scene...

_______________________________________________________________________________________

Disclosures

The information contained herein is for informational purposes only and is developed from sources believed to be providing accurate information. The opinions expressed are those of the author, are for general information, and should not be considered a solicitation for the purchase or sale of any security. The decision to review or consider the purchase or sell of any security should not be undertaken without consideration of your personal financial information, investment objectives and risk tolerance with your financial professional.

Forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

Any market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

Past Performance does not guarantee future results.

Comments