Fed Pushes Markets Around

- Scott Poore

- Nov 24, 2025

- 2 min read

Fed rate cut doubts push markets lower in spite of solid economic fundamentals. Markets dropped more than 1% on Thursday of last week as the probability of a

December rate cut fell to 39%. On Friday, the probability increased to 71% on Fed Governor Williams' comments. Williams, known to be a close ally of Fed Chairman Powell, indicated there is still room for a potential cut. However, the market is now coming to the realization that the Fed is split and that dissents are the new forward guidance, not just dissecting Powell's comments as the voice of the Fed. With valuations high and economic information still delayed from the shutdown, the Fed's December decision is everything for investors for the time being.

Meanwhile, economic fundamentals seems to be holding up well. We finally received the jobless claims from the last several weeks during the government shutdown and

all things being equal, the numbers are actually quite good. Prior to the shutdown, Initial Jobless Claims were at 218,000. The latest number for last week came in at 220,000 claims, so not much of a change overall. In addition, the September report for Nonfarm Payrolls showed 119,000 jobs added to the economy. We're still missing the October report, but in light of some of the headline layoff reports, the labor market is holding up so far.

The good news is that November 24th is historically a good day for equities. Over the past 75 years, this trading day is the 3rd strongest trading day of the year for the S&P

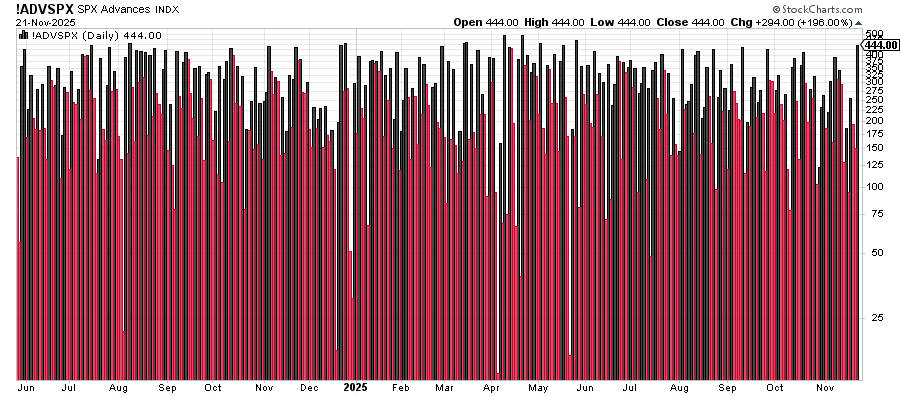

with an average return of +0.47%, according to Ryan Detrick, Chief Market Strategist at Carson Group. He also points out that the market rebound on Friday included 444 stocks in the S&P 500 that traded higher. That's the most in a single day since May of this year. That's coincidentally when the markets were rebounding from April's lows. If November 24th stays true to historical seasonality and equities can put in a floor, perhaps the recent downturn is past us.

Disclosures

The information contained herein is for informational purposes only and is developed from sources believed to be providing accurate information. The opinions expressed are those of the author, are for general information, and should not be considered a solicitation for the purchase or sale of any security. The decision to review or consider the purchase or sell of any security should not be undertaken without consideration of your personal financial information, investment objectives and risk tolerance with your financial professional.

Forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

Any market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

Past Performance does not guarantee future results.

Comments