Chance of Government Re-opening?

- Scott Poore

- Nov 3, 2025

- 3 min read

Momentum stocks inched higher, while most equity sectors lagged last week. As widely expected, the Fed lowered interest rates by 25 basis points at the FOMC meeting last

week. However, despite the fact that the Fed's own Dot-Plot showed rates ending at 350-375 by year-end, the board cast doubt on a December rate cut. Futures on a December rate cut dropped last week from more than 91% just one week ago to only 63% as of Friday. Given the fact that inflation came in lower than expected for September and the Cleveland Fed has projected October inflation (CPI) to be flat, Powell's comments last week were likely uttered to give the Fed wiggle room and to keep investors from getting ahead of the Fed. According to Nick Timiraos, the so-called "Fed Whisperer" at the Wall Street Journal, "Powell's press conference suggests the FOMC is broadly not on board with how heavily priced a December rate cut had become."

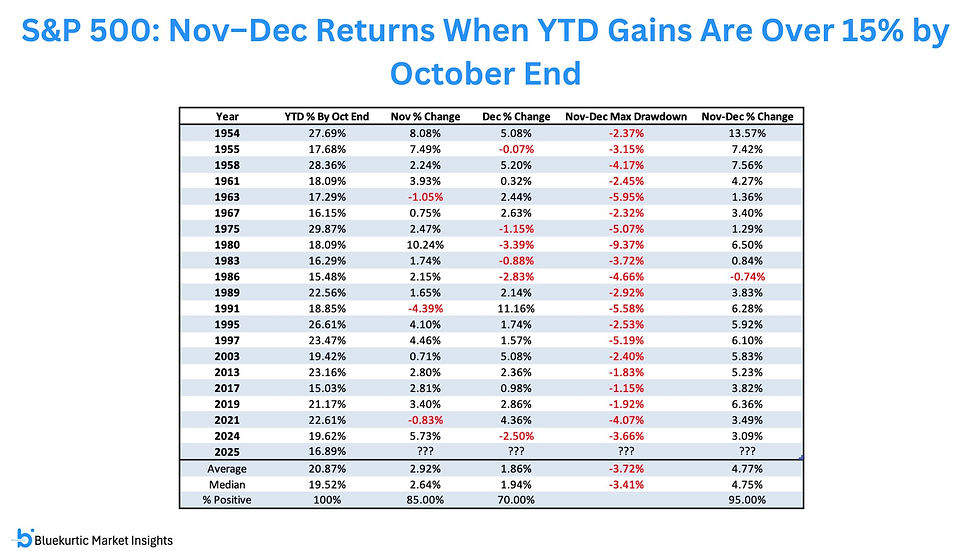

History is on the side of equity markets continuing higher, at least through year-end.

When the Fed cuts rates within all-time highs on the S&P, stocks are typically positive 1-year later. In similar fashion, when the year-to-date return on the S&P 500 Index is up over 15% by October end (currently +16%), the November-December return is positive 95% of the time, going back to 1954, with the average return +4.77%. On the negative side, if the 5% probability came to fruition, the average max drawdown for the November-December period is -3.72%, which would be a healthy pull back from current levels.

Meanwhile, there are some cracks beneath the surface that warrant close monitoring.

Currently, $500 billion of private credit has been deployed in new loans in 2025. That amounts to a total of $1.5 trillion in global private credit in the market. Several companies conduct due diligence and rate private credit - Kroll, Egan-Jones, Morningstar DBRS, & EuroRating - to name a few, but their ratings are not published so it's difficult to determine how much private credit is considered "risky." Private Credit currently accounts for 35% of insurance companies' assets. A diversification strategy that matches long-term risk tolerance and return expectations is the best defense against a market pull back. There has been some talk in D.C. of the government possibly re-opening this week. We'll have to wait and see if politicians can come to some kind of agreement in the immediate future.

Disclosures

The information contained herein is for informational purposes only and is developed from sources believed to be providing accurate information. The opinions expressed are those of the author, are for general information, and should not be considered a solicitation for the purchase or sale of any security. The decision to review or consider the purchase or sell of any security should not be undertaken without consideration of your personal financial information, investment objectives and risk tolerance with your financial professional.

Forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

Any market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

Past Performance does not guarantee future results.

Comments